The Process of Vanuatu Citizenship Residency

Welcome to our blog, where we will be exploring the enticing opportunities that come with Vanuatu Citizenship Residency. In this comprehensive guide, we will delve into the various benefits and advantages of obtaining Vanuatu citizenship, from its travel and business perks to the rights and privileges it offers. We will also shed light on the necessary investment and application process, as well as the potential tax implications and challenges. Whether you are considering Vanuatu for personal or professional reasons, join us as we uncover the ins and outs of Vanuatu Citizenship Residency.

Exploring the Benefits of Vanuatu Citizenship Residency

The benefits of Vanuatu citizenship residency are numerous and far-reaching. Vanuatu, a stunning island nation located in the South Pacific, offers a unique program that allows individuals to obtain citizenship and permanent residency through an investment in the country. This article will delve into the various advantages that come with becoming a Vanuatu citizen and resident.

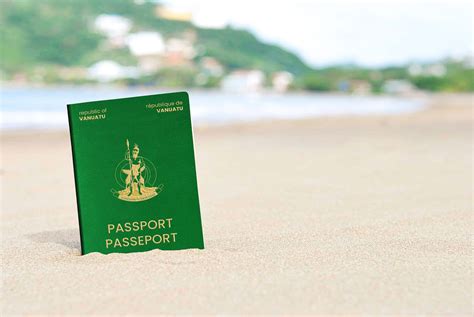

One of the key benefits of Vanuatu citizenship residency is the visa-free travel opportunities it provides. Vanuatu passport holders enjoy visa-free access to over 130 countries, including popular travel destinations such as the United Kingdom, Europe’s Schengen Area, Hong Kong, Singapore, and many more. This opens up a world of opportunities for those seeking to explore different cultures, conduct business internationally, or simply enjoy leisurely travel without the hassle of visa applications and restrictions.

In addition to seamless travel, Vanuatu citizenship residency offers attractive tax benefits. The country does not impose personal income tax, wealth tax, or capital gains tax on its residents. This means that individuals who obtain Vanuatu citizenship can legally benefit from a tax-free status, potentially saving significant amounts of money each year. It is important to note, however, that tax obligations in other countries may still apply, so it is advisable to seek professional advice regarding international tax planning.

- Visa-free access to over 130 countries

- No personal income tax, wealth tax, or capital gains tax

| Benefits | Details |

|---|---|

| Visa-Free Travel | Access to over 130 countries without visa requirements |

| Tax Benefits | No personal income tax, wealth tax, or capital gains tax |

Furthermore, being a Vanuatu citizen provides a secure investment opportunity. The country offers a range of investment options, including real estate, government bonds, or contributions to the Vanuatu Development Support Program. This means that individuals can not only gain citizenship and residency but also potentially benefit from the returns on their investment. Vanuatu’s thriving tourism industry and ongoing development projects make it an attractive destination for investment, with a promising outlook for the future.

The advantages of Vanuatu citizenship residency extend beyond financial considerations. The country offers a safe and peaceful environment, with a low crime rate and political stability. Additionally, the warm tropical climate, pristine beaches, and diverse natural beauty of Vanuatu make it an ideal place for those seeking an exceptional quality of life. Residents can enjoy a relaxed and laid-back lifestyle, surrounded by breathtaking scenery and a welcoming community.

In conclusion, exploring the benefits of Vanuatu citizenship residency reveals a wealth of advantages encompassing visa-free travel, attractive tax benefits, investment opportunities, and an exceptional quality of life. Whether it is for leisure, business, or personal reasons, Vanuatu provides a unique avenue for individuals to obtain citizenship and permanent residency while enjoying the countless benefits offered by this stunning island nation.

Understanding the Required Investment for Vanuatu Citizenship Residency

In order to obtain Vanuatu citizenship residency, there is a specific investment requirement that applicants must fulfill. The Vanuatu Development Support Program (VDSP) offers two investment options that individuals can choose from – a cash donation or a real estate investment. It is important to understand the details and benefits of each option before making a decision.

1. Cash Donation: Applicants can choose to make a cash donation to the Vanuatu government in exchange for citizenship residency. The minimum investment amount for a single applicant is USD 130,000 and USD 150,000 for a family of four. This option allows investors to contribute directly to the development of Vanuatu while gaining the advantage of residency and potential future business opportunities.

2. Real Estate Investment: Another pathway to obtain Vanuatu citizenship residency is through a real estate investment. Applicants can purchase qualifying properties with a minimum value of USD 250,000. It is essential to ensure that the chosen property is approved by the Vanuatu government and meets all the necessary requirements. This option not only grants residency but also provides the opportunity for potential capital appreciation in the Vanuatu property market.

It is important to note that the required investment is subject to change, and it is advisable to consult with authorized agents or Vanuatu government representatives for the most up-to-date information.

| Investment Option | Minimum Investment Amount |

|---|---|

| Cash Donation | USD 130,000 (single) or USD 150,000 (family of four) |

| Real Estate Investment | USD 250,000 or higher |

By understanding the required investment for Vanuatu citizenship residency, individuals can make an informed decision based on their financial capabilities and long-term goals. Whether opting for a cash donation or a real estate investment, both options offer unique advantages and opportunities for individuals and families seeking to secure their residency in Vanuatu.

Evaluating the Application Process for Vanuatu Citizenship Residency

The application process for obtaining Vanuatu citizenship residency requires careful evaluation to ensure a smooth and successful journey towards achieving residency in this beautiful Pacific island nation. Vanuatu offers several pathways for individuals and families seeking citizenship, including the Vanuatu Development Support Program (VDSP) and the Vanuatu Contribution Program (VCP). Before embarking on this process, it is essential to understand the requirements, procedures, and timelines involved.

One of the key benefits of the Vanuatu Development Support Program is its straightforward application process. Applicants must meet certain criteria, including being at least 18 years old, having a clean criminal record, and being able to provide proof of source of funds. The program offers a fast-track option, allowing applicants to receive their residency within 30-60 days upon successful completion of the necessary paperwork and due diligence. The simplicity of the process makes it an attractive option for individuals looking to obtain Vanuatu citizenship residency.

When evaluating the application process, it is important to consider the required investment for Vanuatu citizenship residency. The Vanuatu Contribution Program offers two investment options: a non-refundable contribution to the government’s Development Support Program or an investment in pre-approved real estate. The non-refundable contribution option requires a set amount, which varies depending on the number of applicants. On the other hand, the real estate investment option allows applicants to invest in approved properties, which can be sold after five years to recoup the initial investment. Understanding the financial commitment involved is crucial in making an informed decision.

- Vanuatu Development Support Program (VDSP)

- Vanuatu Contribution Program (VCP)

- Fast-track option

- Required investment

- Real estate investment option

| Program | Requirements | Timeline |

|---|---|---|

| Vanuatu Development Support Program (VDSP) | 18 years or older, clean criminal record, proof of source of funds | 30-60 days |

| Vanuatu Contribution Program (VCP) | Non-refundable contribution or investment in pre-approved real estate | Varies |

Evaluating the application process for Vanuatu citizenship residency is essential to understand the requirements, investment options, and timelines involved. Whether choosing the Vanuatu Development Support Program or the Vanuatu Contribution Program, individuals and families must carefully consider their financial capabilities and eligibility criteria. Vanuatu offers a streamlined process with attractive benefits, making it an appealing choice for those seeking residency in this stunning island nation.

The Advantages of Vanuatu Citizenship Residency for Travel and Business

Vanuatu is a small Pacific island nation that has been gaining attention in recent years for its Citizenship Residency program. This program offers a variety of benefits, particularly for those who are looking to travel and conduct business internationally. In this blog post, we will explore some of the advantages that Vanuatu Citizenship Residency can provide in terms of travel and business opportunities.

One of the main advantages of Vanuatu Citizenship Residency is the ease of travel it offers. Vanuatu passport holders have visa-free or visa-on-arrival access to over 130 countries, including popular travel destinations such as the Schengen Zone, the United Kingdom, and Singapore. This allows individuals with Vanuatu Citizenship Residency to travel freely and explore new cultures without the hassle and stress of applying for visas in advance.

Furthermore, Vanuatu Citizenship Residency provides favorable business opportunities. The country has a low tax regime, with no income tax, capital gains tax, or inheritance tax. This makes it an attractive location for entrepreneurs and investors looking to establish or expand their businesses. In addition, Vanuatu has a stable political environment and a well-regulated financial system, providing a secure and reliable foundation for business endeavors.

- Visa-free or visa-on-arrival access to over 130 countries

- Low tax regime

- Stable political environment

- Well-regulated financial system

In terms of travel, Vanuatu offers a unique and diverse range of attractions for tourists. The country is home to breathtaking natural wonders, including stunning beaches, lush jungles, and picturesque waterfalls. Vanuatu also boasts a rich cultural heritage, with vibrant traditional ceremonies and a distinct Melanesian way of life. With Vanuatu Citizenship Residency, individuals can fully immerse themselves in the beauty and culture of this tropical paradise.

In conclusion, the advantages of Vanuatu Citizenship Residency for travel and business are significant. With visa-free travel to numerous countries and a favorable business environment, Vanuatu provides individuals with the opportunity to explore the world and pursue their entrepreneurial ambitions. Whether you are a frequent traveler or a budding entrepreneur, Vanuatu Citizenship Residency may be the key to unlocking a world of possibilities.

| Advantages | Benefits |

|---|---|

| Visa-free travel to over 130 countries | Expanded travel opportunities |

| Low tax regime | Attractive business environment |

| Stable political environment | Secure foundation for business |

Examining the Rights and Privileges of Vanuatu Citizenship Residency

Vanuatu citizenship residency offers numerous rights and privileges to individuals who choose to become citizens of this unique Pacific island nation. One of the most significant rights is the freedom of movement. Vanuatu citizens have the privilege to travel to over 100 countries visa-free or with visa-on-arrival access. This includes popular destinations such as the United Kingdom, Singapore, and many countries in the European Union. The ability to travel freely without the hassle of obtaining visas in advance is a major advantage for those who enjoy exploring the world.

Another important right that comes with Vanuatu citizenship residency is the right to reside and work permanently in Vanuatu. This means that individuals who acquire citizenship have the ability to live and work in Vanuatu without any restrictions. Whether you are interested in starting a business, investing in real estate, or simply enjoying the tropical lifestyle, Vanuatu citizenship residency provides the opportunity to make this beautiful country your home.

Furthermore, being a Vanuatu citizen also grants individuals the right to access healthcare and education services. Vanuatu has a well-established healthcare system that provides free or subsidized medical services to its citizens. This ensures that residents have access to quality healthcare when needed. Additionally, Vanuatu offers a range of educational opportunities, including both public and private schools, as well as tertiary institutions. Citizens have the right to enroll their children in these educational institutions, providing them with a solid foundation for their future.

| Rights and Privileges | Description |

|---|---|

| Freedom of Movement | Vanuatu citizens can travel to over 100 countries visa-free or with visa-on-arrival access. |

| Right to Reside and Work | Citizens have the ability to live and work in Vanuatu without any restrictions. |

| Access to Healthcare | Vanuatu citizens have the right to access free or subsidized medical services in the country. |

| Access to Education | Citizens can enroll their children in public and private schools, as well as tertiary institutions. |

In conclusion, Vanuatu citizenship residency offers an array of rights and privileges that make it an attractive option for individuals seeking a new place to call home. The freedom to travel to numerous countries without visa restrictions, the ability to reside and work permanently in Vanuatu, and access to healthcare and education services are just a few of the advantages that come with Vanuatu citizenship. By obtaining Vanuatu citizenship, individuals can embrace a new lifestyle and enjoy the many benefits that this beautiful country has to offer.

Assessing the Tax Implications of Vanuatu Citizenship Residency

Vanuatu Citizenship Residency offers numerous benefits to individuals looking for a new place to call home. With its stunning natural beauty, warm climate, and welcoming community, it is no wonder that many people are considering Vanuatu as their new residency destination. However, before making the decision to move, it is crucial to assess the tax implications associated with Vanuatu Citizenship Residency.

One of the most appealing factors of Vanuatu Citizenship Residency is its tax-friendly environment. Vanuatu does not impose any personal income tax, capital gains tax, or inheritance tax on its residents. This means that individuals who obtain Vanuatu citizenship and choose to reside in the country can enjoy significant tax savings. Additionally, Vanuatu has strict laws on banking confidentiality, allowing individuals to protect their financial privacy.

In addition to the absence of major taxes, Vanuatu also offers attractive tax incentives for businesses. As a Vanuatu resident, you can establish a company and benefit from Vanuatu’s low corporate tax rate of only 0-3%. This low tax burden can lead to increased profitability and business expansion opportunities. Vanuatu’s business-friendly environment combined with its strategic location in the Asia-Pacific region makes it an ideal choice for entrepreneurs and investors.

While Vanuatu offers a favorable tax environment, it is crucial to understand that tax laws and regulations can change over time. It is important for individuals considering Vanuatu Citizenship Residency to stay informed about any updates or amendments to the tax system. Consulting with a qualified tax professional is recommended to ensure compliance with Vanuatu’s tax requirements and to take advantage of any available tax planning strategies.

In conclusion, assessing the tax implications of Vanuatu Citizenship Residency is an important step for individuals considering relocating to this Pacific Island paradise. The absence of major taxes, along with attractive tax incentives for businesses, makes Vanuatu an appealing choice for those seeking tax advantages. However, staying informed about any changes in tax laws and seeking professional advice can help individuals make the most of their tax planning and compliance efforts in Vanuatu.

Realizing the Potential Challenges of Vanuatu Citizenship Residency

Obtaining citizenship residency in Vanuatu offers numerous benefits, including travel freedom, business opportunities, and potential tax advantages. However, it is important to also consider the potential challenges that may arise during the application process and after becoming a citizen resident. These challenges can range from bureaucratic hurdles to cultural adjustments. In this blog post, we will explore some of the key challenges that individuals may face when seeking Vanuatu citizenship residency.

One of the potential challenges of Vanuatu citizenship residency is the lengthy application process. While the process itself is relatively straightforward, it can take several months to complete. Applicants are required to gather various documents, such as a passport, birth certificate, and proof of financial stability. Additionally, a background check and health examination are also necessary. The application process can be time-consuming and require careful attention to detail.

Another challenge that individuals may face is the cultural adjustment to life in Vanuatu. Vanuatu is a diverse and vibrant country with its own unique customs, languages, and traditions. For those coming from different cultural backgrounds, adapting to the local customs and practices can be a learning curve. It is important to approach the experience with an open mind and respect for the local culture.

- Language barrier: Vanuatu is home to over 100 different languages, making communication challenging for newcomers who are not familiar with the local languages. However, English is widely spoken in urban areas and tourist hubs.

- Limited infrastructure: Certain parts of Vanuatu may have limited infrastructure, including access to reliable electricity, internet connectivity, and transportation. This can pose challenges for those accustomed to modern conveniences.

- Healthcare facilities: While Vanuatu has healthcare facilities, they may not be as advanced as those found in other countries. It is essential to research and understand the available healthcare options and potential medical challenges before relocating.

Moreover, maintaining Vanuatu citizenship residency may also have its challenges. For instance, individuals must comply with residency requirements, which may involve spending a minimum number of days in Vanuatu each year. Failure to meet these requirements may result in the revocation of citizenship residency status. Additionally, individuals must stay up to date with any changes in the citizenship laws or policies of Vanuatu.

| Challenge | Potential Solution |

|---|---|

| Language barrier | Learning basic phrases in Bislama, the local lingua franca, can help bridge the gap in communication. |

| Infrastructure limitations | Researching and selecting areas with better infrastructure can mitigate potential challenges. |

| Healthcare facilities | Securing comprehensive health insurance and considering medical evacuation options can provide peace of mind. |

| Maintaining residency requirements | Establishing a routine to ensure compliance with residency obligations and staying informed about any changes in citizenship policies. |

While there may be potential challenges associated with Vanuatu citizenship residency, careful preparation and understanding of these challenges can help individuals overcome them. It is important to approach the process with realistic expectations and seek professional advice when necessary. Overall, Vanuatu offers a unique and enriching experience for those seeking citizenship residency, with the challenges ultimately leading to personal growth and a deeper understanding of the local culture.

Frequently Asked Questions

Question: What are the benefits of Vanuatu citizenship residency?

Answer: Vanuatu citizenship residency offers several benefits, including visa-free travel to numerous countries, access to tax advantages, the option to pass citizenship to future generations, and the ability to invest and conduct business in Vanuatu.

Question: What is the required investment for Vanuatu citizenship residency?

Answer: The required investment for Vanuatu citizenship residency varies depending on the program chosen. Generally, it involves making a financial contribution to the government, acquiring designated assets, or investing in real estate. It is advisable to consult a professional for specific details.

Question: What is the application process for Vanuatu citizenship residency?

Answer: The application process for Vanuatu citizenship residency typically involves submitting necessary documentation, completing application forms, undergoing due diligence checks, and making the required investment. It is recommended to seek assistance from authorized agents or professionals to ensure a smooth application process.

Question: How does Vanuatu citizenship residency benefit travel and business?

Answer: Vanuatu citizenship residency allows holders to enjoy visa-free travel to numerous countries, making it convenient for international travel. Additionally, it provides opportunities for business and investment in Vanuatu, where one can explore the vibrant local economy and potential growth sectors.

Question: What are the rights and privileges of Vanuatu citizenship residency?

Answer: Vanuatu citizenship residency grants individuals various rights and privileges, including the right to reside in Vanuatu, access to social services, the right to own property, and the ability to participate in the country’s economic development.

Question: What are the tax implications of Vanuatu citizenship residency?

Answer: Vanuatu offers attractive tax benefits for its citizens, including no personal income tax, no wealth tax, no inheritance tax, and no capital gains tax. It is worth consulting with tax professionals to understand the specific tax implications based on individual circumstances.

Question: What are the potential challenges of Vanuatu citizenship residency?

Answer: While Vanuatu citizenship residency offers numerous advantages, potential challenges may include adaptability to a different culture, relocation logistics, language barriers, and compliance with local regulations. It is essential to conduct thorough research and seek proper guidance before making any decisions.