St. Kitts and Nevis Citizenship by Investment Program Now Accepts Cryptocurrency as a Wealth Source

St. Kitts and Nevis Citizenship by Investment Program Now Accepts Cryptocurrency as a Wealth Source

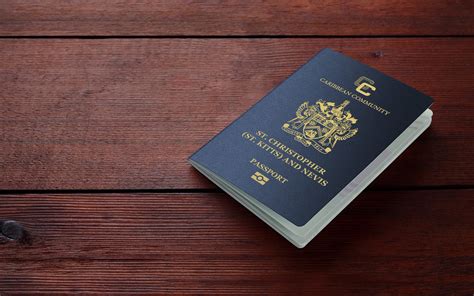

In a groundbreaking move, the St. Kitts and Nevis Citizenship by Investment (CBI) program has announced that it will now accept cryptocurrency as a partial source of wealth for applicants seeking citizenship. This policy shift positions the Caribbean nation at the forefront of integrating digital assets into national economic strategies, offering crypto investors a novel avenue to obtain second citizenship.

The Citizenship by Investment Unit (CIU) of St. Kitts and Nevis communicated this update to its network of authorized agents, outlining the new requirements and procedures. Applicants utilizing cryptocurrency holdings must undergo additional due diligence processes and provide comprehensive documentation to verify the authenticity and legality of their digital assets .

Embracing Digital Assets in Investment Migration

The acceptance of cryptocurrency as a legitimate source of wealth marks a significant evolution in the investment migration landscape. As digital currencies gain mainstream acceptance, St. Kitts and Nevis’ policy change reflects a broader trend of nations adapting to the financial innovations of the digital age.

By recognizing cryptocurrency holdings, the CBI program expands its appeal to a new demographic of investors who have accrued substantial wealth through digital means. This inclusivity not only diversifies the applicant pool but also aligns the nation’s economic development strategies with emerging global financial trends.

Detailed Requirements for Crypto-Based Applicants

Applicants intending to use cryptocurrency as part of their wealth declaration must adhere to specific guidelines to ensure transparency and compliance:

• Comprehensive Documentation: Submission of detailed records demonstrating the origin, value, and ownership of cryptocurrency assets.

• Enhanced Due Diligence: Payment of additional due diligence fees to facilitate thorough background checks and asset verification processes.

• Regulatory Compliance: Adherence to international anti-money laundering (AML) and know-your-customer (KYC) standards to validate the legitimacy of digital assets.

These measures are designed to uphold the integrity of the CBI program while accommodating the unique nature of digital wealth.

Implications for Crypto Investors

The integration of cryptocurrency into the CBI program presents several advantages for digital asset holders:

• Diversification of Investment Portfolios: Opportunity to convert volatile digital assets into stable, government-recognized investments.

• Enhanced Global Mobility: Access to a St. Kitts and Nevis passport, offering visa-free or visa-on-arrival travel to over 150 countries.

• Tax Optimization: Potential benefits from the nation’s favorable tax regime, including no personal income, wealth, or inheritance taxes.

These benefits make the CBI program an attractive option for crypto investors seeking to secure their financial future and expand their global presence.

Yusuf Boz’s Perspective on the Policy Shift

Yusuf Boz, founder of Notte Global and an expert in investment migration, views this development as a strategic alignment with the evolving financial landscape:

“The inclusion of cryptocurrency in the St. Kitts and Nevis CBI program is a forward-thinking move that acknowledges the growing significance of digital assets. It offers crypto investors a viable pathway to secure second citizenship, combining financial innovation with global mobility.”

Boz emphasizes the importance of professional guidance in navigating the complexities of cryptocurrency-based applications to ensure compliance and successful outcomes.

St. Kitts and Nevis vs. Other CBI Programs

While several countries offer citizenship by investment programs, St. Kitts and Nevis distinguishes itself through its progressive stance on digital assets. By accepting cryptocurrency as a wealth source, it sets a precedent that may influence other nations to reevaluate their policies in light of the digital economy’s growth.

This innovation enhances the program’s competitiveness, attracting a broader spectrum of investors and reinforcing the nation’s position as a leader in the investment migration sector.

A New Era for Investment Migration

The decision by St. Kitts and Nevis to accept cryptocurrency as a partial source of wealth in its Citizenship by Investment program marks a significant milestone in the convergence of digital finance and global mobility. This policy not only broadens the program’s appeal but also reflects a commitment to embracing financial innovation.

For crypto investors seeking to leverage their digital assets for enhanced global access and financial security, the St. Kitts and Nevis CBI program offers a compelling opportunity. Engaging with experienced professionals, such as those at Notte Global, can provide the necessary guidance to navigate this innovative pathway to second citizenship.