Saint Lucia Business Immigration

If you are considering business immigration, Saint Lucia is a destination worth exploring. With its stunning natural beauty and a favorable business environment, this Caribbean island offers a range of benefits for foreign entrepreneurs. In this article, we will discuss why Saint Lucia is an ideal choice for business immigration, the requirements for immigrating to the country, the various investment options available, the processing time for immigration applications, the tax advantages for business immigrants, and offer some valuable tips for a successful business immigration to Saint Lucia.

Why choose Saint Lucia for business immigration?

Saint Lucia is becoming an increasingly popular destination for business immigration. Its scenic beauty, stable economy, and favorable immigration policies make it an attractive choice for entrepreneurs and investors.

One of the main reasons to choose Saint Lucia for business immigration is its favorable tax environment. The country has a competitive tax regime with no capital gains, inheritance, or estate taxes. This makes it an ideal location for those looking to maximize their business profits and wealth.

Another advantage of choosing Saint Lucia for business immigration is the investment opportunities it offers. The country has a range of investment options, including real estate, tourism, and agriculture. These sectors are booming in Saint Lucia, providing ample opportunities for entrepreneurs to grow their businesses.

Saint Lucia also offers a fast and efficient process for business immigration. The processing time for applications is relatively short compared to other countries. This means that entrepreneurs can start their business operations in a timely manner and take advantage of the opportunities available in Saint Lucia.

Furthermore, there are several benefits for business immigrants in Saint Lucia. These include access to a highly skilled workforce, a stable political environment, and a high standard of living. The country also provides excellent infrastructure and modern amenities that are essential for business operations.

In conclusion, Saint Lucia is an excellent choice for business immigration. With its favorable tax environment, investment opportunities, efficient processing time, and numerous benefits, it offers a welcoming environment for entrepreneurs and investors. Consider choosing Saint Lucia for your business immigration needs and take advantage of all the opportunities it has to offer.

Requirements for business immigration to Saint Lucia

Are you considering immigrating to Saint Lucia for business purposes? If so, it is important to understand the requirements and eligibility criteria to ensure a smooth and successful immigration process. Saint Lucia offers a favorable business environment and numerous opportunities for entrepreneurs and investors. By fulfilling the necessary requirements, you can take advantage of the benefits and opportunities available in this beautiful Caribbean island.

Eligibility Criteria

In order to qualify for business immigration to Saint Lucia, applicants must meet certain eligibility criteria. These criteria may vary depending on the specific business program you are applying for. However, some common requirements include a minimum age of 18 years, good health, a valid passport, and proof of financial stability. It is also crucial to demonstrate a genuine intention to establish a business or invest in the country.

Investment Options

Saint Lucia offers various investment options for business immigrants. One popular program is the Citizenship by Investment Program (CIP), which requires applicants to make an economic contribution to the country. This can be achieved through a direct donation to the National Economic Fund or through investment in approved real estate, government bonds, or a business venture. By choosing the right investment option, you can fulfill the financial requirements and enhance your chances of obtaining business immigration status in Saint Lucia.

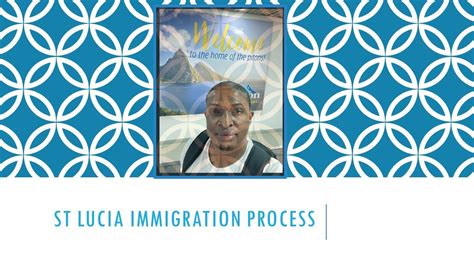

Documentation and Processing Time

When applying for business immigration to Saint Lucia, it is important to gather all the necessary documentation and submit a complete application. Required documents may include a business plan, financial statements, proof of funds, educational certificates, and a police clearance certificate. The processing time for business immigration applications can vary, but on average, it takes around four to six months to receive a decision. It is advisable to consult with an immigration lawyer or an expert to ensure that your application is properly prepared and submitted in a timely manner.

Conclusion

Immigrating to Saint Lucia for business purposes can offer numerous benefits and opportunities for entrepreneurs and investors. However, it is crucial to fulfill the requirements and eligibility criteria set by the government. By understanding the necessary documentation, investment options, and processing time, you can navigate the business immigration process with confidence. It is recommended to seek professional guidance to ensure a successful and smooth transition to Saint Lucia for your business endeavors.

Benefits of business immigration in Saint Lucia

Business immigration can offer numerous benefits to individuals looking to expand their ventures or explore new opportunities in different countries. One such captivating destination for business immigration is Saint Lucia. Located in the eastern Caribbean Sea, Saint Lucia offers a range of advantages that make it an ideal choice for entrepreneurs and investors.

One of the major benefits of business immigration in Saint Lucia is the favorable tax system. Saint Lucia has implemented various tax incentives and exemptions to attract foreign investors. These incentives include tax holidays, lower corporate tax rates, and exemptions on capital gains, dividends, and inheritance taxes. Such advantages not only help businesses to thrive but also enable individuals to grow their wealth and retain a larger portion of their earnings.

Additionally, Saint Lucia provides access to a growing market and robust business opportunities. The country has a stable economy and is known for its tourism industry, which attracts visitors from around the world. By establishing a business in Saint Lucia, entrepreneurs can tap into a vibrant local market while also gaining access to the broader Caribbean region. This expansion potential enhances business prospects and offers entrepreneurs the chance to diversify their ventures.

- Opportunity to expand into a growing market

- Favorable tax system with multiple incentives and exemptions

- Potential for diversification and business growth

| Benefits of Business Immigration in Saint Lucia |

|---|

| Access to a growing market and robust business opportunities |

| Favorable tax system with incentives and exemptions |

| Potential for diversification and business growth |

In addition to these advantages, business immigration in Saint Lucia can also provide individuals with a high standard of living. The country boasts a tropical climate, stunning natural landscapes, and a peaceful environment, making it an attractive place to live and work. With a range of modern amenities and infrastructure, individuals can enjoy a comfortable lifestyle while pursuing their entrepreneurial dreams.

Furthermore, Saint Lucia offers a straightforward business immigration process, making it easier for entrepreneurs to relocate and establish their businesses. The government has implemented efficient procedures and a dedicated agency, the Saint Lucia Citizenship by Investment Unit (CIU), to handle business immigration applications. This streamlined process ensures a smoother transition and enables entrepreneurs to focus on their business objectives.

In conclusion, business immigration in Saint Lucia presents a wealth of benefits for individuals seeking new opportunities. From a favorable tax system to a growing market, the advantages of immigrating for business purposes in Saint Lucia are numerous. Additionally, the high standard of living and straightforward immigration process make it an appealing destination for entrepreneurs and investors. By taking advantage of these benefits, individuals can unlock their potential and thrive in the tropical paradise of Saint Lucia.

Investment options for business immigration in Saint Lucia

When considering business immigration to Saint Lucia, one of the key aspects to explore is the investment options available in the country. Having a clear understanding of these options is crucial for individuals looking to relocate or start a business in Saint Lucia. This blog post will delve into the various investment avenues that can be pursued for business immigration in Saint Lucia.

One of the popular investment options for business immigration in Saint Lucia is the purchase of government bonds. The government of Saint Lucia offers individuals the opportunity to invest in bonds, which can serve as a pathway to obtaining citizenship in the country. These bonds not only provide a safe and secure investment, but also contribute to the development of Saint Lucia’s economy.

Another investment option for business immigration in Saint Lucia is investing in the National Economic Fund (NEF). The NEF is a fund established by the government, with the aim of promoting economic growth and development in the country. By investing a specific amount in the NEF, individuals can become eligible for citizenship in Saint Lucia. This investment option is particularly attractive for those looking for a straightforward and efficient route to business immigration.

In addition to bonds and the NEF, individuals considering business immigration in Saint Lucia can also explore the option of investing in approved real estate projects. The government of Saint Lucia has designated certain real estate developments as qualifying investments for citizenship. By investing in these projects, individuals can not only secure citizenship, but also potentially benefit from rental income or capital appreciation.

- Government bonds

- National Economic Fund (NEF)

- Approved real estate projects

| Investment Options | Benefits |

|---|---|

| Government bonds | Safe and secure investment |

| National Economic Fund (NEF) | Straightforward and efficient route to citizenship |

| Approved real estate projects | Potential rental income or capital appreciation |

Processing time for business immigration in Saint Lucia

When considering business immigration to Saint Lucia, one important factor to take into account is the processing time. Understanding how long the immigration process may take can help potential business immigrants plan accordingly and make informed decisions.

While the exact processing time may vary depending on individual circumstances, it is generally a relatively efficient and streamlined process in Saint Lucia. The government of Saint Lucia has implemented measures to expedite the immigration process for business immigrants, recognizing the positive impact they can have on the country’s economy.

There are several factors that can influence the processing time for business immigration in Saint Lucia. These include the completeness and accuracy of the application, the complexity of the case, and the current workload of the immigration authorities.

Tax advantages for business immigrants in Saint Lucia

When considering business immigration, one important aspect to take into account is the tax advantages that can be gained. Saint Lucia, a beautiful island gem in the Caribbean, has established itself as an attractive destination for business immigrants due to its favorable tax policies. Let’s explore some of the key tax advantages that make Saint Lucia a top choice for entrepreneurs and investors.

1. Low personal income tax rates

One of the most appealing aspects of Saint Lucia’s tax system is its low personal income tax rates. In comparison to many other countries, the income tax rates in Saint Lucia are significantly lower. This means that business immigrants can retain a greater portion of their earnings, allowing for more opportunities for growth and investment.

2. Tax holidays and incentives

Saint Lucia offers attractive tax holidays and incentives for businesses operating in certain sectors. These incentives may include exemptions or reductions in corporate taxes, import duties, and value-added tax (VAT). By taking advantage of these incentives, business immigrants can significantly reduce their tax burden and maximize their profitability.

3. Double taxation treaties

Saint Lucia has entered into double taxation treaties with various countries around the world. These treaties aim to eliminate the double taxation of income that can occur when a business or individual is liable to pay taxes in multiple jurisdictions. By availing of these treaties, business immigrants in Saint Lucia can avoid or reduce the impact of double taxation, ensuring that they do not pay more taxes than necessary.

In conclusion, Saint Lucia offers a range of tax advantages for business immigrants. With its low personal income tax rates, tax holidays and incentives, as well as double taxation treaties, entrepreneurs and investors can take advantage of a favorable tax environment. By choosing Saint Lucia for business immigration, individuals can not only enjoy the natural beauty of the island but also benefit from its attractive tax policies, ultimately enhancing their business prospects.

Tips for a successful business immigration to Saint Lucia

Business immigration to Saint Lucia can be an exciting and rewarding venture for individuals looking to expand their horizons and tap into new markets. However, like any international venture, it requires careful planning and preparation to ensure a successful outcome. In this blog post, we will provide you with some tips to help make your business immigration journey to Saint Lucia a smooth and prosperous one.

1. Understand the Business Environment: Before embarking on your business immigration journey to Saint Lucia, it is crucial to thoroughly research and understand the local business environment. Familiarize yourself with the laws, regulations, and market conditions that may impact your business. This will help you make informed decisions and increase your chances of success.

2. Seek Professional Assistance: Engaging the services of a professional immigration consultant or lawyer can greatly simplify the process and save you time and effort. They can guide you through the immigration requirements and help you navigate any complex paperwork. Additionally, they can provide you with valuable insights and advice to make your business immigration journey smoother.

3. Build a Strong Business Plan: A well-crafted business plan is essential for any successful business venture. Outline your goals, objectives, marketing strategies, and financial projections in a clear and concise manner. This will not only help you secure necessary funding but also demonstrate your commitment and vision to potential business partners, investors, and authorities in Saint Lucia.

4. Network and Establish Connections: Building a network of contacts and establishing connections in Saint Lucia is critical for your business immigration journey. Attend local business events, join industry associations, and connect with like-minded individuals in your field. Cultivating relationships with local professionals, entrepreneurs, and potential clients can open doors to new opportunities and collaborations.

5. Adapt to the Local Culture: Understanding and embracing the local culture in Saint Lucia can significantly improve your chances of success. Take the time to learn about the customs, traditions, and business etiquette of the country. Respect and appreciate the local way of doing business, and make an effort to build strong relationships based on trust and mutual understanding.

In conclusion, a successful business immigration journey to Saint Lucia requires careful planning, professional assistance, a strong business plan, networking, and cultural adaptability. By following these tips, you can set yourself up for success and capitalize on the numerous opportunities that await you in this beautiful Caribbean nation.

Frequently Asked Questions

Why choose Saint Lucia for business immigration?

Saint Lucia offers a favorable business environment with a stable political and economic climate, making it an attractive destination for entrepreneurs looking to expand or relocate their businesses.

What are the requirements for business immigration to Saint Lucia?

The requirements for business immigration to Saint Lucia include having a viable business plan, meeting the minimum investment threshold, and complying with all immigration laws and regulations.

What are the benefits of business immigration in Saint Lucia?

Business immigration in Saint Lucia allows individuals to enjoy benefits such as tax advantages, access to a skilled workforce, potential business expansion opportunities, and the ability to obtain permanent residency or citizenship.

What investment options are available for business immigration in Saint Lucia?

Saint Lucia offers investment options such as investing in a government-approved project, establishing a new business, or investing in an existing local business.

How long is the processing time for business immigration in Saint Lucia?

The processing time for business immigration in Saint Lucia can vary depending on the specific circumstances, but it generally takes several months to complete the application process.

What are the tax advantages for business immigrants in Saint Lucia?

Business immigrants in Saint Lucia can benefit from a competitive tax regime, including low personal income tax rates, tax exemptions on certain types of income, and no inheritance or capital gains taxes.

What tips can contribute to a successful business immigration to Saint Lucia?

To ensure a successful business immigration to Saint Lucia, it is important to thoroughly research the market, seek professional advice, develop a comprehensive business plan, and comply with all legal and regulatory requirements.