Investment Options for the Spain Golden Visa Program

Are you considering relocating to Spain and obtaining a Golden Visa? If so, you’ll want to explore the various investment opportunities available to you. In this blog post, we will provide an overview of the Spain Golden Visa program, highlighting its benefits and risks. We will delve into real estate investments, government bonds, business ventures, investment funds, startups, and diversifying your investment portfolio. By the end, you’ll have a comprehensive understanding of the different paths you can take to secure your Golden Visa in Spain. Let’s get started!

Overview of the Spain Golden Visa Program

The Spain Golden Visa Program is a popular initiative that allows non-European Union citizens and their families to obtain residency in Spain by making a qualifying investment. This program was introduced in 2013 and has gained significant attention from investors around the world. The goal of the Spain Golden Visa Program is to attract foreign capital and stimulate economic growth in the country.

One of the key benefits of the Spain Golden Visa Program is that it offers a fast-track process for obtaining residency. Once an investor meets the program’s requirements and makes the necessary investment, they can expect to receive their visa within a few months. This is a major advantage for individuals who are seeking an efficient and expedited pathway to residency in Spain.

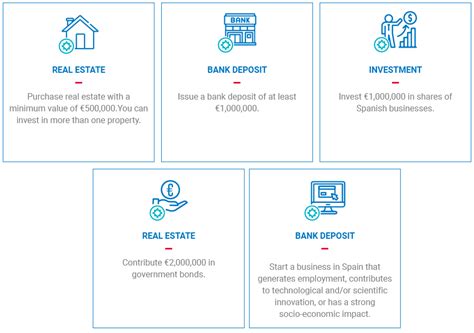

There are several investment options available under the Spain Golden Visa Program. The most common option is real estate investment, where investors can purchase property with a minimum value of 500,000 euros. This not only provides individuals with an opportunity to own property in a desirable location but also offers the potential for rental income or capital appreciation over time.

In addition to real estate investments, the Spain Golden Visa Program also allows investors to obtain residency through other means. This includes investing in Spanish government bonds with a minimum value of 2 million euros, or making a capital investment of at least 1 million euros in Spanish companies or projects. These alternative investment options provide investors with flexibility and the opportunity to diversify their investment portfolio.

- Fast-track process for obtaining residency

- Real estate investment option

- Investing in Spanish government bonds

- Capital investment in Spanish companies or projects

- Flexibility and diversification

| Investment Option | Minimum Investment |

|---|---|

| Real Estate | 500,000 euros |

| Government Bonds | 2 million euros |

| Capital Investment | 1 million euros |

Real Estate Investments for the Spanish Golden Visa

Real estate investments can be a lucrative path to obtaining the Spanish Golden Visa. This program offers non-European Union citizens the opportunity to gain residency in Spain by making a significant investment in the country. With its vibrant property market and a range of investment options, Spain provides an attractive destination for individuals seeking to capitalize on the benefits of the Golden Visa program. In this blog post, we will explore the various aspects of real estate investments for the Spanish Golden Visa.

One of the primary advantages of investing in real estate for the Spanish Golden Visa is the wide range of investment opportunities available. From residential properties in popular cities like Barcelona and Madrid to coastal villas in popular tourist destinations like Marbella, there is a diverse selection of properties to choose from. Additionally, investors can also explore the option of commercial properties such as hotels or office spaces. The flexibility in investment choices allows individuals to tailor their real estate investment to their specific preferences and financial goals.

Investing in real estate for the Spanish Golden Visa offers several benefits. Firstly, it provides a tangible asset that can appreciate over time, potentially generating a significant return on investment. Spain’s property market has shown resilience and growth in recent years, making it an attractive option for investors. Furthermore, owning a property in a prime location in Spain can also provide additional benefits such as rental income or personal use of the property during holidays. This dual-purpose investment can not only serve as a pathway to the Golden Visa but also generate ongoing financial advantages.

- Appreciation Potential: Real estate investments have the potential to appreciate in value over time, allowing investors to benefit from capital gains.

- Rental Income: Properties located in popular tourist destinations can generate rental income, providing a steady stream of cash flow.

- Flexible Use: Investors can choose to utilize the property themselves for vacations or rent it out for additional income.

While real estate investments for the Spanish Golden Visa offer numerous advantages, it is essential to consider potential risks as well. One of the risks involves market fluctuations. As with any investment, the value of real estate can rise and fall due to various factors such as economic conditions, regulatory changes, or shifts in demand. Additionally, investors should also be mindful of the costs associated with property ownership, including maintenance, property taxes, and insurance. Conducting thorough research and seeking advice from professionals can help mitigate these risks and make informed investment decisions.

Table: Investment Options for Real Estate Investments

| Investment Option | Minimum Investment Amount | Residency Status |

|---|---|---|

| Residential Property | €500,000 | Non-working residency permit |

| Commercial Property | €1,000,000 | Non-working residency permit |

| Rural Property | €500,000 | Non-working residency permit |

In conclusion, real estate investments offer an excellent avenue for obtaining the Spanish Golden Visa. With its diverse range of investment options, potential for appreciation, and additional advantages such as rental income and personal use, investing in Spanish real estate can be a rewarding endeavor. However, it is crucial to weigh the benefits against the risks and make well-informed decisions. By understanding the market, conducting thorough research, and seeking professional guidance, investors can maximize their chances of success in their real estate investments for the Spanish Golden Visa.

Investing in Spanish Government Bonds for the Golden Visa

When it comes to obtaining a Golden Visa in Spain, there are various investment options available. One such option is investing in Spanish government bonds. This investment avenue not only offers a secure and reliable investment opportunity but also opens doors to numerous benefits, including the coveted Golden Visa. In this blog post, we will explore the process of investing in Spanish government bonds for the Golden Visa, the benefits it provides, and the potential risks involved.

Benefits of Investing in Spanish Government Bonds for the Golden Visa

Investing in Spanish government bonds brings with it a range of advantages. Firstly, these bonds are considered safe and stable investments, as they are backed by the Spanish government. This provides investors with a sense of security knowing that their investment is in safe hands. Secondly, by investing in Spanish government bonds, individuals become eligible for the Golden Visa program. This program allows non-European Union citizens to obtain residency in Spain and enjoy benefits such as visa-free travel across the Schengen Area. Additionally, the Golden Visa provides a pathway to Spanish citizenship after five years of residency.

Risks Associated with Investing in Spanish Government Bonds

While investing in Spanish government bonds offers numerous benefits, it is important to be aware of the associated risks. One of the key risks is the possibility of changes in interest rates. If interest rates rise, the value of existing bonds may decrease. Moreover, investing in government bonds also exposes investors to the risk of inflation. Inflation erodes the purchasing power of the bond’s future cash flows, reducing its overall value. It is crucial for potential investors to carefully analyze and assess the risks involved before making any investment decisions.

Conclusion

Investing in Spanish government bonds for the Golden Visa is a viable and attractive option for individuals seeking residency in Spain. Not only does it provide a safe and stable investment avenue, but it also grants access to the benefits of the Golden Visa program. However, it is important to remember that every investment carries its own set of risks. It is advisable to consult with financial advisors and conduct thorough research before diving into any investment venture.

Exploring Business Investment Opportunities for the Golden Visa

The Golden Visa program in Spain offers foreign investors the opportunity to obtain residency and, eventually, citizenship by making certain investments in the country. One of the investment options available under this program is to explore business investment opportunities. By investing in businesses within Spain, foreign investors can not only fulfill the requirements of the Golden Visa program but also tap into the thriving Spanish market.

Investing in businesses in Spain not only provides a pathway to residency and citizenship but also offers numerous advantages and benefits. Firstly, it allows investors to gain exposure to the Spanish market, which is known for its dynamic and diverse industries. Spain is home to a wide range of sectors, including tourism, technology, manufacturing, and renewable energy, presenting ample opportunities for investors to diversify their portfolios.

Moreover, investing in businesses also allows Golden Visa investors to actively participate in the growth and development of the Spanish economy. By supporting local businesses, foreign investors can contribute to job creation, innovation, and economic stability in Spain. This not only benefits the investor personally but also strengthens the overall economic landscape of the country, making it an attractive option for those seeking to make a long-term investment.

- Access to a thriving market: Investing in businesses in Spain provides access to a dynamic and diverse market with numerous industry sectors.

- Diversification of investment portfolio: By investing in different businesses, investors can reduce risk and broaden their investment portfolio.

- Active participation: Investing in businesses allows Golden Visa investors to actively participate in the growth and development of the Spanish economy.

| Benefits | Risks |

|---|---|

| Access to a thriving market | Potential market fluctuations |

| Diversification of investment portfolio | Uncertainty in business performance |

| Active participation in economic growth | Regulatory and legal challenges |

While exploring business investment opportunities for the Golden Visa can bring numerous benefits, it is essential to carefully assess and manage the associated risks. Market fluctuations, uncertainty in business performance, and regulatory challenges are factors that need to be considered.

Overall, investing in businesses presents a unique opportunity for foreign investors to not only fulfill the requirements of the Golden Visa program but also actively contribute to the Spanish economy. It allows investors to gain access to a thriving market, diversify their investment portfolios, and have a hand in the country’s growth and development. However, it is crucial to conduct thorough research and seek professional advice to navigate the risks and make informed investment decisions.

Investment Funds as a Path to the Spain Golden Visa

When exploring investment options for obtaining the Spain Golden Visa, one avenue to consider is investment funds. Investment funds, also known as mutual funds, offer individuals the opportunity to pool their money together with other investors to invest in a diversified portfolio of assets. These funds are managed by professional fund managers who make investment decisions on behalf of the investors.

Investing in an investment fund can be a viable option for those looking to obtain the Spain Golden Visa. Here are a few reasons why:

- Diversification: Investment funds provide investors with the benefit of diversification. Instead of investing in a single asset or company, investors can gain exposure to a wide range of assets, such as stocks, bonds, and real estate, through a single investment fund. This diversification helps to reduce risk and maximize potential returns.

- Professional Management: When investing in an investment fund, individuals can rely on the expertise of professional fund managers. These managers have in-depth knowledge of the market and can make informed investment decisions on behalf of the investors. This takes away the stress of managing investments and allows investors to focus on other aspects of their lives.

- Accessibility: Investment funds are easily accessible to investors. Individuals can invest in funds with low entry barriers, allowing them to start investing with a relatively small amount of capital. This makes investment funds an attractive option for individuals who may not have a significant amount of funds to invest initially.

While investment funds offer several advantages, it is important to consider the risks associated with them:

| Benefits | Risks |

|---|---|

| Diversification | Market Volatility |

| Professional Management | Lack of Control |

| Accessibility | Fees and Expenses |

Market volatility is one of the main risks associated with investment funds. The value of the fund can fluctuate depending on the performance of the underlying assets. Investors may experience losses if the market goes down.

Another risk is the lack of control over the investments. Investors rely on the expertise of the fund managers to make investment decisions. They do not have direct control over which assets are included in the fund’s portfolio.

Lastly, investors should be aware of the fees and expenses associated with investment funds. These may include management fees, sales charges, and other operating expenses. These costs can eat into the overall returns of the investment.

In conclusion, investment funds can be a viable path to obtaining the Spain Golden Visa. They offer diversification, professional management, and accessibility to investors. However, it is important to understand and consider the associated risks, such as market volatility, lack of control, and fees. It is always advisable to conduct thorough research and seek professional advice before making any investment decisions.

Benefits and Risks of Investing in Startups for the Golden Visa

Investing in startups can be an exciting and potentially lucrative venture. Startups are known for their innovative ideas and high growth potential. For individuals looking to obtain a Golden Visa in Spain, investing in startups can be a viable option. In this blog post, we will explore the benefits and risks associated with investing in startups for the Golden Visa program.

Benefits:

1. Potential for high returns: Startups have the potential to grow rapidly and generate significant returns on investment. By investing in a successful startup, individuals can potentially earn substantial profits.

2. Diversification: Investing in startups allows individuals to diversify their investment portfolio. This can help spread the risk and minimize losses. By allocating a portion of their investments to startups, individuals can potentially benefit from the success of multiple companies.

3. Access to innovative ideas: Startups are often at the forefront of innovation. By investing in startups, individuals gain access to new and disruptive ideas that can transform industries. This can provide an opportunity to be part of groundbreaking advancements and potentially benefit financially.

Risks:

1. High failure rate: Startups are known for their high failure rates. Many startup ventures do not succeed, and investors may lose their entire investment. It is important to carefully evaluate the business model and management team of a startup before making an investment.

2. Illiquid investment: Investments in startups are often illiquid, meaning that it may be difficult to sell or transfer the investment before the company goes public or is acquired. This lack of liquidity can make it challenging to access funds in case of a financial need.

3. Lack of track record: Startups typically have a limited track record, making it difficult to assess their potential for success. Investors may not have access to extensive historical financial data or performance metrics, making it a riskier investment compared to more established companies.

In conclusion, investing in startups for the Golden Visa program can offer both benefits and risks. It is important for individuals to carefully evaluate each investment opportunity and diversify their portfolio to mitigate risks. By understanding the potential risks and rewards associated with startups, individuals can make informed investment decisions and potentially benefit from the growth and success of innovative companies.

Diversifying Your Investment Portfolio for the Spanish Golden Visa

The Spanish Golden Visa program offers a unique opportunity for individuals looking to invest in Spain and gain residency in the country. One effective strategy for maximizing the benefits of this program is to diversify your investment portfolio. Diversification allows you to spread your investments across different asset classes and sectors, reducing the overall risk of your portfolio. In this blog post, we will explore the importance of diversification and how it can help you make the most of your investment for the Spanish Golden Visa.

One key advantage of diversifying your investment portfolio for the Spanish Golden Visa is that it allows you to tap into different sectors of the Spanish economy. Spain is known for its robust real estate market, but there are also other promising sectors such as tourism, technology, and renewable energy. By allocating your investments across these different sectors, you can benefit from potential growth opportunities in each area.

Furthermore, diversification across various asset classes can provide a hedge against market volatility. While real estate investments may offer stability and long-term growth potential, other asset classes such as stocks, bonds, and mutual funds can offer higher returns in a shorter period. By spreading your investments across these different asset classes, you can balance the risk and reward within your portfolio.

- Real Estate: Investing in properties and rental units can provide a steady stream of rental income and potential capital appreciation.

- Stocks: Investing in Spanish companies listed on the stock market can offer the opportunity for significant returns, especially if you choose growing industries.

- Bonds: Purchasing Spanish government bonds can provide a fixed income stream and relatively lower risk compared to other investments.

- Mutual Funds: Investing in mutual funds allows you to access a diversified portfolio managed by professionals, spreading your risk across several assets.

In addition to diversifying across different asset classes, it is also crucial to consider geographic diversification. Spain is part of the European Union, which means you have the freedom to invest in other EU countries. This provides you with additional investment opportunities and further reduces your investment risk.

| Asset Class | Benefits | Risks |

|---|---|---|

| Real Estate | Steady rental income, potential capital appreciation | Fluctuations in the real estate market, liquidity constraints |

| Stocks | Potential high returns, ownership in growing companies | Market volatility, company-specific risk |

| Bonds | Fixed income stream, lower risk compared to stocks | Interest rate fluctuations, credit risk |

| Mutual Funds | Professional management, diversification | Management fees, potential underperformance |

In conclusion, diversifying your investment portfolio is a smart strategy when aiming for the Spanish Golden Visa. By spreading your investments across different sectors, asset classes, and even geographic locations, you can minimize risks and maximize the potential returns. Remember to carefully evaluate each investment opportunity, consider your risk tolerance, and seek professional advice to ensure a well-diversified portfolio that aligns with your investment goals.

Frequently Asked Questions

What is the Spain Golden Visa Program?

The Spain Golden Visa Program is a residency by investment program that allows foreign investors to obtain a Spanish residency visa by making certain qualifying investments in the country.

How can I obtain the Spain Golden Visa through real estate investments?

You can obtain the Spain Golden Visa by investing a minimum of €500,000 in residential or commercial real estate in Spain. This investment must be maintained for a minimum of five years in order to maintain your residency.

Can I obtain the Spain Golden Visa by investing in Spanish government bonds?

Yes, you can obtain the Spain Golden Visa by investing a minimum of €2 million in Spanish government bonds. This investment must be maintained for a minimum of five years in order to maintain your residency.

What are some business investment opportunities for the Spain Golden Visa?

There are various business investment opportunities available for the Spain Golden Visa, including investing in existing Spanish companies, starting a new business, or becoming a stakeholder in a Spanish company with a minimum investment of €1 million.

Can investment funds be used as a path to the Spain Golden Visa?

Yes, investment funds can be used as a path to the Spain Golden Visa. By investing a minimum of €1 million in Spanish investment funds, you can qualify for the Golden Visa program.

What are the benefits and risks of investing in startups for the Spain Golden Visa?

The benefits of investing in startups for the Spain Golden Visa include potential high returns and the opportunity to contribute to the growth of innovative businesses. However, the risks include the possibility of losing your investment if the startup fails.

How can I diversify my investment portfolio for the Spain Golden Visa?

You can diversify your investment portfolio for the Spain Golden Visa by considering a combination of real estate investments, government bonds, business investments, and investment funds. This can help spread the risk and increase the potential for returns.