Exploring the Advantages of Investing in the United States Real Estate Market

Investing in real estate has been a tried and true method of building wealth for centuries. However, with global markets becoming increasingly interconnected, it’s essential for investors to consider opportunities beyond their own borders. The United States, in particular, offers a plethora of advantages for those looking to diversify their portfolio and maximize their returns. In this blog post, we will explore the many benefits of investing in US real estate, ranging from steady appreciation to tax advantages and stable cash flow. Additionally, we will discuss how leveraging US real estate investments can amplify profits and unlock the potential in the US market. Join us on this journey as we delve into the reasons why investing in US real estate could be a game-changer for your financial future.

Steady Appreciation: A Key Benefit of Investing in US Real Estate

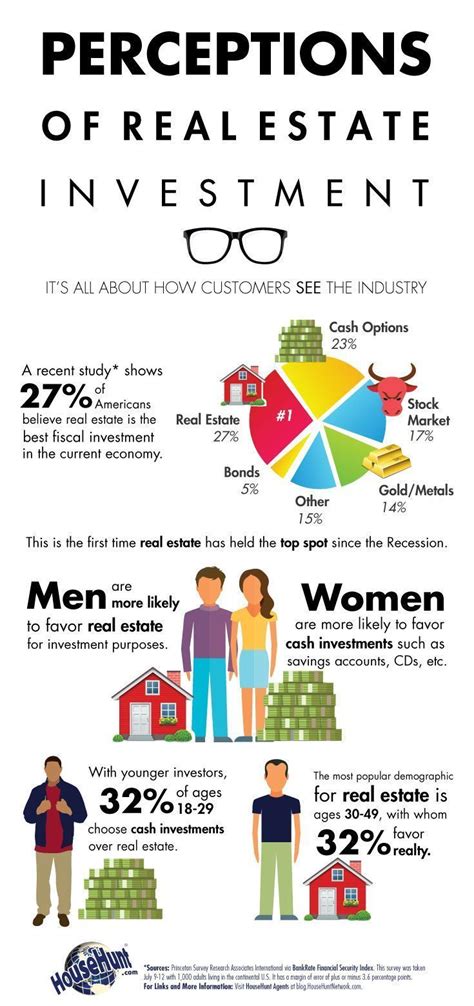

Investing in real estate is a popular way to grow wealth and secure financial stability. Among the many benefits of investing in US real estate, steady appreciation stands out as a key advantage. Appreciation refers to the increase in the value of a property over time. By investing in the US real estate market, investors have the opportunity to enjoy steady appreciation, which can lead to substantial financial gains in the long run.

One of the main reasons why US real estate experiences steady appreciation is the strong and stable economy of the country. The United States is known for its robust economy, which attracts domestic as well as international investors. The stability of the US economy provides a favorable environment for real estate to appreciate consistently over time. Economic growth, job opportunities, and population growth all contribute to the demand for properties, which drives up their value.

Another factor that plays a significant role in the steady appreciation of US real estate is the scarcity of land. Land is a finite resource, and as the population continues to grow, the demand for land and properties increases. However, the supply of land remains limited, leading to increased competition among buyers. This competition drives up property prices, resulting in steady appreciation over time.

- Location: The location of a property greatly influences its appreciation potential. Investing in prime locations such as major cities, highly sought-after neighborhoods, or areas close to amenities and infrastructure can significantly increase the likelihood of steady appreciation.

- Market conditions: The overall health of the real estate market plays a crucial role in property appreciation. Favorable market conditions, such as low-interest rates, high demand, and limited inventory, can contribute to steady appreciation.

- Maintenance and improvements: Properly maintaining and improving a property can enhance its value over time. Investing in renovations, upgrades, and regular maintenance can boost appreciation and attract higher selling prices in the future.

| Benefits of Investing in US Real Estate | Key Advantage |

|---|---|

| Steady Appreciation | The increase in property value over time |

| Diversification Opportunities | Unlocking the potential in the US market |

| Tax Benefits | Maximizing returns through US real estate investment |

| Stable Cash Flow | Generating passive income with US properties |

| Leverage Advantage | Amplifying profits with US real estate investments |

Investing in US real estate offers investors the opportunity to benefit from steady appreciation. The strong and stable economy, limited supply of land, and various factors at play contribute to the consistent increase in property values. By carefully selecting prime locations, understanding market conditions, and maintaining properties effectively, investors can enhance appreciation potential. With steady appreciation, investing in US real estate can be a rewarding long-term investment strategy.

Diversification Opportunities: Unlocking the Potential in the US Market

When it comes to investing, diversification is the key to reducing risks and maximizing returns. And one area that offers significant diversification opportunities is the US real estate market. With its vast size and diverse property types, the US market provides investors with a wide range of options to choose from.

Firstly, investing in US real estate allows investors to tap into various geographical locations. Whether it’s a bustling city like New York or a picturesque beach town in California, the US offers a plethora of regions with unique economic and demographic characteristics. By diversifying across different locations, investors can benefit from the growth potential of multiple markets and mitigate the risk associated with a single location.

Secondly, the US real estate market offers diverse property types, catering to different investment strategies and risk appetites. From residential properties to commercial buildings, industrial warehouses to hospitality assets, there is a property type suitable for every investor. This wide range of options allows investors to diversify their portfolio and reduce vulnerability to market fluctuations in a specific sector.

Furthermore, the US market provides opportunities to invest in various real estate investment vehicles. Investors can choose to invest directly in properties or opt for real estate investment trusts (REITs), which are companies that own and manage income-generating real estate. REITs offer a convenient way to access the US market, as they provide exposure to a diversified portfolio of properties without the need for direct property ownership.

Additionally, investing in US real estate can also provide international investors with currency diversification benefits. By investing in US dollars, investors can shield their portfolio from fluctuations in their home currency. This currency diversification can act as a hedge against potential uncertainties in the global economy, further enhancing the attractiveness of US real estate investments.

In conclusion, the US real estate market offers ample opportunities for diversification, allowing investors to unlock its full potential. By investing in different geographic locations, diverse property types, and various investment vehicles, investors can mitigate risks and maximize returns. Furthermore, the currency diversification benefits make US real estate investments even more attractive for international investors. So, if you are looking to diversify your investment portfolio, consider exploring the opportunities offered by the US market.

Tax Benefits: Maximizing Returns through US Real Estate Investment

Investing in real estate can be a fruitful venture, especially in the United States. Apart from the potential for high returns, there are several other benefits that make US real estate investment an attractive option for investors. One of these benefits is the tax advantages that come with investing in US properties.

One of the tax benefits of investing in US real estate is the ability to deduct the interest paid on a mortgage. This deduction can significantly reduce the taxable income for real estate investors, which in turn maximizes their overall returns. Additionally, real estate investors in the US may also deduct property taxes, insurance premiums, and other expenses related to the property. These deductions can further reduce the tax burden and ultimately increase the profitability of the investment.

Another tax advantage of investing in US real estate is the option to defer capital gains taxes through a 1031 exchange. A 1031 exchange allows investors to sell a property and reinvest the proceeds into a new property without paying immediate capital gains taxes. By deferring these taxes, investors can keep more money in their pockets to potentially reinvest and further maximize their returns.

- In terms of passive income generation, US real estate offers favorable tax rates on rental income. Income generated from rental properties is often taxed at a lower rate compared to ordinary income. This lower tax rate allows investors to keep more of their rental income and potentially grow their investment portfolio more quickly.

- Additionally, real estate investors in the US may also benefit from depreciation deductions. The IRS allows investors to deduct a portion of the property’s value every year as a depreciation expense. This deduction can offset rental income, further reducing the taxable income and increasing the overall returns for investors.

| Tax Benefits | Advantages |

|---|---|

| Deduction of mortgage interest | Reduces taxable income and increases overall returns |

| Option to defer capital gains taxes | Allows for reinvestment of proceeds and potential growth |

| Favorable tax rates on rental income | Increases passive income and investment portfolio growth |

| Depreciation deductions | Offset rental income and reduce taxable income |

Maximizing returns through US real estate investment involves not only understanding the market dynamics but also leveraging the tax benefits available to investors. By taking advantage of deductions, deferring capital gains taxes, and benefiting from favorable tax rates, investors can optimize their returns and create a lucrative real estate portfolio in the United States.

Stable Cash Flow: Generating Passive Income with US Properties

Generating passive income is a dream for many individuals looking to secure a stable financial future. One avenue that can help achieve this goal is investing in US properties. Real estate investments in the US offer a unique opportunity to create a stable cash flow, providing a consistent stream of income that requires minimal effort on the investor’s part.

One of the major benefits of investing in US properties is the potential for steady appreciation. Unlike other forms of investment, such as stocks or bonds, real estate values tend to appreciate over time. This means that as the value of the property increases, so does your potential for passive income. By investing in US properties, you can benefit from the long-term growth of the real estate market and enjoy a stable cash flow that grows along with your investment.

Another advantage of investing in US properties is the diversification opportunities it offers. The US market is vast and diverse, with a wide range of properties available for investment. Whether you’re interested in residential, commercial, or rental properties, there are plenty of options to choose from. By diversifying your real estate portfolio, you can spread out your risk and increase your chances of generating a stable cash flow over the long term.

Leverage Advantage: Amplifying Profits with US Real Estate Investments

When it comes to investing in the US real estate market, one key benefit that cannot be overlooked is the leverage advantage. Leverage, in the context of real estate investments, refers to the use of borrowed capital to increase the potential return on an investment. This can be a powerful tool for investors looking to amplify their profits.

One way to leverage in real estate is through the use of financing options such as mortgages. By obtaining a loan to purchase a property, an investor can use a relatively small amount of their own money (known as the down payment) to control a much larger asset. This allows them to benefit from any appreciation in the property’s value, while only having to invest a fraction of the total cost.

Additionally, leverage can also be achieved through partnerships or joint ventures. By pooling resources and combining capital with other investors, individuals can access larger and more lucrative real estate opportunities that would otherwise be out of reach. This not only spreads the risk among multiple parties but also increases the potential for higher returns.

Furthermore, leveraging can also be applied by using the built-in equity in existing properties to acquire additional ones. For instance, if an investor owns a property that has appreciated in value, they can refinance it and use the released equity as a down payment for a new investment. This allows them to continuously grow their real estate portfolio and maximize their profits over time.

In conclusion, the leverage advantage plays a crucial role in amplifying profits with US real estate investments. Whether through financing options, partnerships, or utilizing existing equity, investors can use leverage to control larger assets and take advantage of market appreciation. However, it is important to note that leverage also carries certain risks and should be approached with caution. Proper analysis, risk management, and understanding of the market are essential for successful leveraging in real estate.

List of Benefits:

- Increased potential return on investment

- Access to larger and more lucrative opportunities

- Continuous growth of real estate portfolio

- Maximization of profits over time

Table: Leverage Advantage Examples

| Investment | Investor’s Initial Investment | Financed Amount | Total Investment | Profit |

|---|---|---|---|---|

| Property A | $50,000 | $200,000 | $250,000 | $100,000 |

| Property B | $75,000 | $300,000 | $375,000 | $150,000 |

| Property C | $100,000 | $400,000 | $500,000 | $200,000 |

Frequently Asked Questions

Question 1: Why is steady appreciation a key benefit of investing in US real estate?

Answer: Steady appreciation in US real estate refers to the gradual increase in property values over time. This is a key benefit because it allows investors to build wealth and potentially earn significant profits when they decide to sell their properties.

Question 2: How can investing in US real estate provide diversification opportunities?

Answer: Investing in the US real estate market allows investors to diversify their portfolio by adding an asset class that is not directly correlated to traditional stocks and bonds. This diversification can help reduce risk and increase the chances of achieving long-term financial goals.

Question 3: What are the tax benefits of investing in US real estate?

Answer: US real estate investment offers various tax benefits, including deductions for mortgage interest, property taxes, and depreciation expenses. Additionally, through the use of legal structures like limited liability companies (LLCs), investors can minimize their tax liability and maximize their returns.

Question 4: How can investing in US properties generate stable cash flow?

Answer: Investing in rental properties in the US can provide a steady stream of rental income, which offers a stable cash flow. With proper property management and a strong rental market, investors can generate passive income that can be used to cover expenses, fund further investments, or enjoy financial freedom.

Question 5: What is the leverage advantage of US real estate investments?

Answer: The leverage advantage in US real estate investing refers to the ability to use borrowed money to purchase properties. This allows investors to amplify their profits and potentially earn higher returns on their initial investment, as they can control a larger asset with a relatively smaller amount of their own money.

Question 6: How can investors maximize their returns through US real estate investment?

Answer: Investors can maximize their returns by strategically investing in US real estate, conducting thorough market research, and identifying properties with growth potential. Additionally, using strategies such as rental property optimization, value-add renovations, and timely property sales can further enhance returns on investment.

Question 7: What should investors consider before investing in US real estate?

Answer: Before investing in US real estate, investors should consider factors such as their financial goals, risk tolerance, market conditions, location, property management, and legal requirements. It is important to conduct proper due diligence, work with knowledgeable professionals, and develop a well-defined investment strategy to increase the chances of success.