Comparing the Real Estate Markets of Texas and Florida

Welcome to today’s blog post where we will be exploring the intriguing real estate landscapes of Texas and Florida. From the vast geographical differences to the economic factors that affect the housing market in these states, we will delve into the housing affordability and market trends, as well as uncover the investment opportunities that lie within each region. Whether you’re a potential homeowner or a savvy investor, join us as we compare and contrast the real estate markets of Texas and Florida, and discover the potential growth that awaits in these vibrant states.

Geographical Differences: Texas vs. Florida

The geographical differences between Texas and Florida make these two states distinct in various ways. From their size and shape to their natural features and climate, each state offers a unique experience for residents and visitors alike.

Firstly, let’s consider the size and shape of these states. Texas, known for its “bigger is better” mentality, is the second-largest state in the United States, covering a vast area of approximately 268,820 square miles. In contrast, Florida is comparatively smaller, with an area of around 65,755 square miles. This significant size difference contributes to the diverse landscapes and ecosystems found in each state.

When it comes to natural features, Texas boasts impressive geographical diversity. It is home to picturesque deserts, rolling plains, majestic mountains, and stunning coastline along the Gulf of Mexico. Florida, on the other hand, is renowned for its beautiful beaches, marshes, swamps, and the massive Everglades National Park, which serves as a crucial habitat for numerous wildlife species.

Furthermore, the climate of Texas and Florida varies significantly due to their location and size. Texas experiences hot summers and mild winters, with temperature extremes varying across different regions. In contrast, Florida is known for its tropical climate, with warm temperatures throughout the year and high humidity, particularly in the summer months. The Gulf Stream’s proximity influences Florida’s climate, bringing cool breezes and occasional tropical storms.

In conclusion, the geographical differences between Texas and Florida contribute to their unique appeal. While Texas impresses with its vast size, diverse landscapes, and dynamic climate, Florida entices with its stunning beaches, lush vegetation, and tropical climate. Whether one prefers the arid landscapes of Texas or the coastal charm of Florida, both states offer an array of natural wonders waiting to be explored.

Economic Factors Affecting Real Estate

Economic factors play a significant role in the real estate market and can greatly impact property values and investment opportunities. Understanding these factors and how they affect the real estate industry is crucial for both buyers and sellers. In this blog post, we will explore the key economic factors that influence the real estate market and discuss their implications for investors and homeowners.

1. Interest Rates: One of the most influential economic factors affecting real estate is interest rates. When interest rates are low, borrowing costs decrease, making it more affordable for individuals to purchase properties. This can lead to increased demand and higher property prices. Conversely, when interest rates rise, borrowing becomes more expensive and can dampen buyer enthusiasm, potentially leading to a slowdown in the real estate market.

2. Employment and Income: The state of the job market and overall income levels are critical indicators of the real estate market’s health. When employment rates are high and incomes are rising, people have more purchasing power and are more likely to invest in real estate. Areas with strong job growth and high-income levels tend to have a thriving real estate market, while areas with stagnating or declining employment rates may experience a slowdown in property demand.

3. Economic Growth: The overall economic growth of a region has a significant impact on its real estate market. When an area experiences robust economic growth, businesses are expanding, job opportunities are plentiful, and consumer confidence is high. This positive economic climate attracts individuals and businesses to the area, driving up property values and creating new investment opportunities. On the other hand, areas with stagnant or declining economies may face challenges in the real estate market, with decreased demand and lower property values.

4. Inflation: Inflation refers to the general increase in prices over time, and it directly affects the purchasing power of consumers. In an inflationary environment, the cost of goods and services rises, including the cost of real estate. As property values tend to increase at a rate equal to or higher than inflation, real estate can act as a hedge against inflation. Investors often view real estate as a tangible asset that can retain value and provide a reliable source of income during inflationary periods.

5. Government Policies and Regulations: Government policies and regulations can greatly influence the real estate market. Changes in tax laws, zoning regulations, and lending policies can have both positive and negative impacts on property values and investment opportunities. For example, government initiatives that promote affordable housing can lead to increased demand and potential investment opportunities, while restrictive zoning regulations may limit development and impact property supply and prices.

| Economic Factors | Impact on Real Estate Market |

|---|---|

| Interest Rates | Affects affordability and demand |

| Employment and Income | Influences purchasing power and demand |

| Economic Growth | Attracts investment and increases property values |

| Inflation | Real estate can act as a hedge against inflation |

| Government Policies and Regulations | Can impact property values and investment opportunities |

It is essential for both buyers and sellers to stay informed about the economic factors that affect the real estate market. By understanding these factors and their potential impact, individuals can make informed decisions and maximize their real estate investments. Whether you are a prospective buyer looking for investment opportunities or a homeowner considering selling, keeping a close eye on economic indicators will help you navigate the dynamic real estate market.

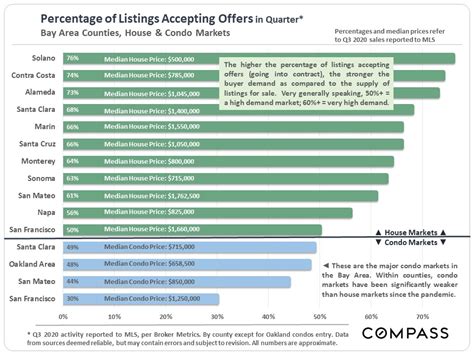

Housing Affordability: Texas vs. Florida

Housing affordability is a key consideration for many people when deciding where to live. In this blog post, we will compare the housing affordability in Texas and Florida, two states that are popular for their warm weather and diverse economies.

When it comes to housing affordability, both Texas and Florida have their advantages. In Texas, the cost of living is generally lower compared to many other states, including Florida. This translates to lower housing prices and, consequently, higher affordability. Texas also has a strong job market, which means residents have a better chance of finding well-paying jobs to support their housing needs.

In contrast, Florida is known for its booming tourism industry, which contributes to a higher cost of living. The demand for housing in popular coastal cities like Miami and Naples drives up prices, making it less affordable for many residents. However, Florida does have some areas that are more affordable, especially in the central and northern parts of the state.

Let’s take a look at some specific numbers to understand the housing affordability in Texas and Florida. According to the latest data, the median home price in Texas is $211,000, while in Florida it is slightly higher at $248,000. However, it’s important to note that the median income in Texas is also lower compared to Florida, with Texas residents earning around $59,000 per year on average, whereas Florida residents earn about $57,000 per year on average.

In terms of affordability, experts typically use the rule of thumb that stipulates no more than 30% of a person’s income should go towards housing costs. Based on this guideline, a person earning the median income in Texas would be spending around 22% of their income on housing, while in Florida, it would be closer to 26%. These figures indicate that Texas has a slightly higher housing affordability compared to Florida.

| Median Home Price | Median Income | Affordability Percentage | |

|---|---|---|---|

| Texas | $211,000 | $59,000 | 22% |

| Florida | $248,000 | $57,000 | 26% |

In conclusion, while both Texas and Florida offer housing options at various price ranges, Texas tends to have a slightly higher affordability compared to Florida. However, it’s important to consider other factors such as job opportunities, quality of life, and personal preferences when deciding where to live. Ultimately, the choice between Texas and Florida will depend on individual circumstances and priorities.

Market Trends and Growth Potential

When it comes to investing in real estate, understanding market trends and growth potential is essential. This knowledge can help investors make informed decisions about where to put their money and maximize their return on investment. In this blog post, we will explore market trends and growth potential in the real estate markets of Texas and Florida, two states that have consistently shown strong performance in the housing sector.

In recent years, both Texas and Florida have experienced significant growth in their real estate markets. This can be attributed to several factors, including population growth, job opportunities, and favorable business environments. As more people move to these states in search of better job prospects and a lower cost of living, the demand for housing has increased, driving up property values and rental prices.

One key market trend to consider is the shift towards urban living. In both Texas and Florida, major cities like Austin, Houston, Miami, and Orlando have seen a surge in urban development and a rise in mixed-use properties. Millennials and empty nesters alike are seeking out walkable neighborhoods with access to amenities such as restaurants, shops, and entertainment options. As a result, properties in these urban areas tend to hold their value well and offer a high potential for growth.

- Population growth

- Job opportunities

- Favorable business environments

- Shift towards urban living

- Mixed-use properties

- Walkable neighborhoods

- Access to amenities

| Factors | Texas | Florida |

|---|---|---|

| Population Growth | High | High |

| Job Opportunities | Abundant | Abundant |

| Business Environment | Business-friendly | Business-friendly |

| Urban Living Trend | Strong | Strong |

| Mixed-Use Properties | Increase | Increase |

| Walkable Neighborhoods | Available | Available |

| Access to Amenities | Abundant | Abundant |

Another factor contributing to the growth potential in both Texas and Florida is the presence of investment opportunities in various sectors. From commercial properties to vacation rentals, these states offer a diverse range of real estate options for investors. Business-friendly policies and supportive local economies create an environment that encourages entrepreneurial ventures, making Texas and Florida attractive destinations for property investment.

As with any investment, it is important to consider the risks associated with real estate. Factors such as economic downturns, natural disasters, and regulatory changes can impact the market and affect growth potential. Conducting thorough research and consulting with industry professionals can help mitigate these risks and ensure a more successful investment journey.

In conclusion, the real estate markets in Texas and Florida exhibit strong market trends and growth potential. With factors like population growth, job opportunities, and the shift towards urban living, these states offer a promising landscape for investors. By staying informed about market trends, assessing investment opportunities, and understanding the risks involved, investors can make informed decisions and capitalize on the growth potential in these markets.

Investment Opportunities: Texas and Florida

When it comes to real estate investment, Texas and Florida are two states that often come to mind. Both states boast promising investment opportunities, but each offers its unique set of advantages and challenges. In this blog post, we will explore the investment potential in both Texas and Florida, highlighting the geographical differences, economic factors, and housing affordability that can affect your investment decisions.

Geographically, Texas and Florida differ significantly. Texas, the second-largest state in the United States, offers vast open spaces and diverse landscapes. From the rolling plains of West Texas to the picturesque coastline, the state provides a wide range of investment options. On the other hand, Florida is known for its stunning beaches, tropical climate, and unique ecosystem. The state’s geographical features attract tourists and retirees, making it a popular destination for real estate investment.

Economic factors play a crucial role in determining the investment potential of a region. Both Texas and Florida have robust economies, but they differ in terms of industry focus. Texas has a strong presence in various sectors, including energy, technology, and healthcare. The state’s favorable business environment and low taxes make it an attractive destination for businesses and investors alike. Florida, on the other hand, relies heavily on tourism, hospitality, and international trade. The state’s growing population and diverse economy create numerous investment opportunities.

- Housing affordability is another factor that investors consider when choosing between Texas and Florida. In recent years, Texas has gained a reputation for its relatively affordable housing market. The state’s lower cost of living and favorable property taxes make it an appealing option for first-time homebuyers and real estate investors. On the contrary, Florida’s housing market tends to be more expensive, especially in prime locations like Miami and Orlando. However, opportunities for high rental yields and appreciation potential may offset the initial higher costs.

Given their market trends and growth potential, both Texas and Florida offer excellent investment opportunities. Texas has experienced steady population growth, favorable job market conditions, and a robust housing market. Florida, on the other hand, benefits from its tourist attractions, favorable tax climate, and a growing number of retirees. Investors looking for long-term appreciation may find Texas more appealing, while those seeking higher rental incomes and vacation rentals may lean towards Florida.

| Factors | Texas | Florida |

|---|---|---|

| Geography | Diverse landscapes, vast open spaces | Stunning beaches, tropical climate |

| Economy | Strong presence in energy, technology, healthcare | Relies on tourism, hospitality, international trade |

| Housing Affordability | Relatively affordable, lower cost of living | Generally more expensive, especially in prime locations |

| Market Trends | Steady population growth, robust housing market | Tourist attractions, growing number of retirees |

Ultimately, the decision to invest in Texas or Florida depends on your investment goals, risk tolerance, and personal preferences. Both states offer unique opportunities and potential for success. Whether you prefer the diversity of Texas or the allure of Florida, thoroughly researching the local market and understanding the investment factors will help you make an informed decision. So, take your time, weigh the pros and cons, and embark on a real estate investment journey in either Texas or Florida!

Frequently Asked Questions

What are the geographical differences between Texas and Florida?

Texas is located in the southern central part of the United States, while Florida is in the southeastern part. Texas is known for its vast size and diverse landscapes, ranging from deserts and plains to forests and mountains. Florida, on the other hand, is known for its tropical climate, beautiful beaches, and the Everglades.

What economic factors affect real estate in Texas and Florida?

Several economic factors can impact the real estate market in both Texas and Florida. These factors include employment rates, population growth, interest rates, and the overall state of the economy. Additionally, factors such as infrastructure development, industry growth, and government policies can also influence the real estate market.

How does housing affordability compare between Texas and Florida?

While both Texas and Florida offer relatively affordable housing compared to some other states, there are some differences. Texas generally has a lower cost of living, including more affordable housing options in cities like Houston and San Antonio. On the other hand, Florida tends to have higher housing costs, especially in popular areas like Miami and Orlando.

What are the market trends and growth potential in Texas and Florida?

Both Texas and Florida have experienced significant growth in recent years, fueling their real estate markets. Texas has been attracting businesses and individuals with its robust economy and job opportunities, while Florida’s warm climate and tourism industry contribute to its growth. Both states also have growing populations, which creates a demand for housing and provides potential investment opportunities.

Where can I find investment opportunities in Texas and Florida?

There are various investment opportunities in both Texas and Florida, depending on your interests and goals. In Texas, cities like Austin, Dallas, and Houston are known for their thriving tech and energy industries, making them attractive areas for real estate investments. In Florida, cities such as Miami, Orlando, and Tampa offer opportunities in tourism, hospitality, and real estate development.

What are the advantages of investing in Texas?

Investing in Texas can offer several advantages. The state has a diverse and robust economy, with a strong energy sector, technology industries, and a favorable business climate. Additionally, Texas has seen consistent population and job growth, which can contribute to the appreciation of real estate assets over time.

What are the advantages of investing in Florida?

Investing in Florida comes with its own set of advantages. The state’s warm climate and attractive beaches make it a popular tourist destination, ensuring a steady stream of visitors and potential rental income. Florida also has a growing retiree population, which can offer opportunities in the senior housing and healthcare sectors. Additionally, Florida benefits from having no state income tax, which can be advantageous for investors.